Investment Pool

McMaster’s investments are distributed into Investment Manager products. Each product will hold investments in financial instruments across multiple sectors. Investment Manager products are selected and monitored against policy objectives associated with both performance and decarbonization targets. Performance risk is managed using investment manager products to diversify holdings across different asset classes (e.g. fixed income, public equities, real estate, and infrastructure), geographies, investment styles.

McMaster University supports Investment Manager divestment decisions where companies fail to set meaningful plans and targets aligned to the Paris Agreement. The United Nations endorsed the Paris Agreement, which calls on companies to set measurable globally accepted carbon targets to achieve a 50% reduction in carbon emissions by 2030. McMaster’s carbon reduction objective for the portfolio is more accelerated than the Paris Agreement, with a 75% reduction goal across all invested assets by 2030 and the rest as soon as possible thereafter. McMaster’s weighted average carbon intensity is 25% lower than the All Country World Index – Ex Fossil Fuels benchmark.

The selection of investment managers incorporates traditional performance and governance considerations with additional environment, social, and governance (“ESG”) considerations associated with the United Nations 17 sustainable development goals. All of McMaster’s Investment Managers are signatories to the UN Principles for Responsible Investment (“PRI”). All Investment Managers use an ESG-Integrated approach, aligned with the CFA Institute’s current guidance, as part of the manager’s overall company selection process.

McMaster University is a UN PRI signatory and has adopted the Task force Recommendations for Climate-related Financial Disclosures (“TCFD”), which recommends tracking weighted average carbon intensity across portfolio assets and targeting reduction over time. In addition, McMaster is tracking the portfolio’s investments in clean technology solutions and its decreasing exposure to fossil fuel reserves targeting divestment. McMaster’s TCFD transparency disclosures related to governance, strategy, risk, metrics and targets are included in the Annual Financial Report.

Investment Managers

Investment managers are monitored quarterly by the Investment Pool Committee in accordance with the policies and procedures approved annually by the Board of Governors. With McMaster’s adoption of TCFD, a historical record of past investment managers is captured in each Annual Financial Report.

The Investment Pool uses both pooled and segregated Investment Manager products. Pooled fund investment products often provide access to investments, managers and/or investment strategies that would not be accessible directly in a segregated account. While pooled products provides greater access to investment opportunities, the risk associated with pooled products is that McMaster does not have discretionary direction or control over the companies selected by the Investment Manager. Instead the Investment Manager of a pooled product is hired for alignment to the McMaster’s policy and will assess each company added or removed from its product using its ESG-integrated approach reviewed and accepted by the Investment Pool Committee.

Segregated or discretionary funds can be directed by the Investment Pool Committee, however if asset classes are removed from a product the performance benchmark used to evaluate the investment manager may need to be changed at the same time.

The current investment managers and products used are listed below with links to the company’s website for further information.

Information Box Group

Real Estate

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| Bentall Kennedy | Prime Canadian Property Fund LP | Pooled |

| Fiera Real Estate | GPM Real Property (12) LP | Pooled |

| Fiera Real Estate Small CAP Industrial Fund LP | Pooled | |

| Harrison Street | Harrison Street Core Property Fund | Pooled |

| Morgan Stanley | Morgan Stanley Prime Property Fund | Pooled |

| MetLife | MetLife Commercial Mortgage Investment Fund | Pooled |

Fixed Income

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| Beutel Goodman & Company Ltd. | Universe Bond Portfolio | Segregated |

| BlackRock Asset Management Canada Limited | Blackrock Canadian Universe Bond Fund | Pooled |

| IShares Core Canadian Short Term Fund | ETF |

US Equities

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| BlackRock Asset Management Canada Limited | Blackrock Russel 1000 Alpha Tilts B Fund Low Carbon | Segregated |

| Mesirow Financial | U.S. Small CAP Equities Portfolio | Segregated |

Information Box Group

EAFE Equities

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| Aristotle | Aristotle Capital Management | Segregated |

| Harris Associates L.P. | Oakmark International Equity L.P. | Pooled |

| Morgan Stanley Investment Management Inc. | Morgan Stanley International Opportunity Fund | Pooled |

| Russell Investments Canada Ltd. | Russell Investments ESG Global Equity Pooled Fund | Pooled |

Infrastructure

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| Brookfield Investment Management | Brookfield Super Core Infrastructure Fund | Pooled |

| Brookfield Global Transition (Infrastructure) Fund | Pooled | |

| Ingeo formly known as First Sentier | First Sentier Global Diversified Infrastructure Fund | Pooled |

| Harrison Street | Harrison Street Social Infrastructure Fund | Pooled |

Canadian Equities

| MANAGERS | PRODUCT | POOLED OR SEGREGATED |

| Clarivest | Canadian Equities Portfolio | Segregated |

| Foyston, Gordon & Payne Inc. | FGP Canadian Equity Fund | Pooled |

| PCJ Investment Counsel Ltd. | Canadian Equities Portfolio | Segregated |

Weighted Average Carbon Intensity

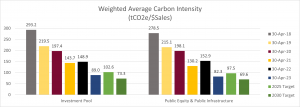

The weighted average carbon intensity measures the Investment Pool’s exposure to potential carbon-intensive companies, expressed in tons greenhouse gas converted to carbon dioxide emissions using the greenhouse gas protocol per million sales, written as tCO2e/$Sales. This metric is recommended by TCFD after global consultations involving over 1,100 organizations.

The weighted average carbon intensity (“WACI”) for the Investment Pool as at April 30, 2023 is 89.0 tCO2e/$MSales based on 84.3% data availability, as measured by MSCI. The Investment Pool’s WACI is 24.8% lower than the WACI measure for the All-Country World Index (ACWI) ex-Fossil Fuel Benchmark.

The weighted average carbon intensity for public equity is 82.3/tCO2e/$Sales based on 98.1% data availability. The Investment Pool’s public equity and public infrastructure WACI is 26.1% lower than the WACI measure for the ACWI ex-Fossil Fuel Benchmark.

Where data is not available, Scope 1 and 2 carbon emissions are estimated using MSCI’s proprietary carbon estimation model.

McMaster adopted a decarbonization strategy in 2018 aligned with the United Nations Principles for Responsible Investment and began measuring and targeting carbon exposure across all asset classes and investment manager products to track progress against carbon reduction targets embedded into the Investment Pool’s policy and procedures. Since 2018, the Investment Pool has reduced carbon exposure by 69.6% and within public equity by 70.4%. McMaster’s original goal to reduce carbon exposure by 45% by 2030 has been achieved. McMaster’s updated carbon reduction goals aim to reduce WACI by 65% by 2025 and 75% by 2030 with the rest as soon as possible thereafter. In addition to Investment Manager ESG-Integrated approaches to selecting companies within each product, McMaster uses further active engagement strategies through a University Network for Investor Engagement. McMaster monitors investment manager’s active stewardship through company engagements and proxy voting, the University supports investment manager divestment decisions where companies fail to set plans aligned to the Paris Agreement targets.

Source: MSCI Investment Pool and MSCI Public Equity & Public Infrastructure Reports: 2018, 2019, 2020, 2021, 2022, 2023

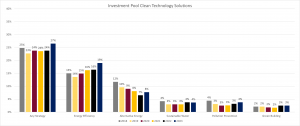

Clean Technology Solutions

The Investment Pool includes holdings in companies that offer clean technology solutions. MSCI measures the weight of these companies that offer clean technology solutions based on sales across the following categories: alternative energy, energy efficiency, green building, pollution prevention, and sustainable water. The Investment Pool weight of companies offering clean technology solutions is 26.5%, and across public equity holdings the weight is 36.7%.

The Investment Pool weights by category are shown in the chart below:

Source: MSCI Investment Pool Reports: 2018, 2019, 2020, 2021, 2022, 2023

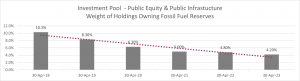

Fossil Fuel Reserves

The Investment Pool initiated a decarbonization strategy in 2018 aligned with the United Nations Principles for Responsible Investing. The Investment Pool tracks the weight of publicly traded holdings owning fossil fuel reserves and specific high impact fossil fuels such as coal, oil sands, shale oil and shale gas that are more exposed to stranded asset risk. Coal is by far the most intensive fuel emitting twice the emissions per kilowatt hour than natural gas. Stranded asset risk has focused on thermal coal, which is mainly used in power generation. While both thermal and metallurgical coal have a high carbon content, metallurgical, or coking coal is used in steel making and has few substitutes, so many investment managers believe thermal coal is more vulnerable to stranding whereas there will still be a future need for metallurgical coal since substitutes such as natural resources are insufficient in supply and durability.

The Investment Pool public equity weight of holdings owning fossil fuel reserves has decreased 59.2% since 2018.

Source: MSCI Investment Pool Reports: 2018, 2019, 2020, 2021, 2022. 2023

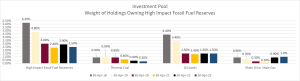

The Investment Pool has a 2.5% weight of holdings owning high impact fossil fuel reserves representing a decrease of 59.7% since 2018.

Source: MSCI Investment Pool Reports: 2018, 2019, 2020, 2021, 2022, 2023