Accounts Payable

| AP Processing | Target June 2022 |

Actual June 2022 |

| Time elapsed for expense reports rec’d in AP and processed by AP | <1 day (quarterly average) | 0.99 |

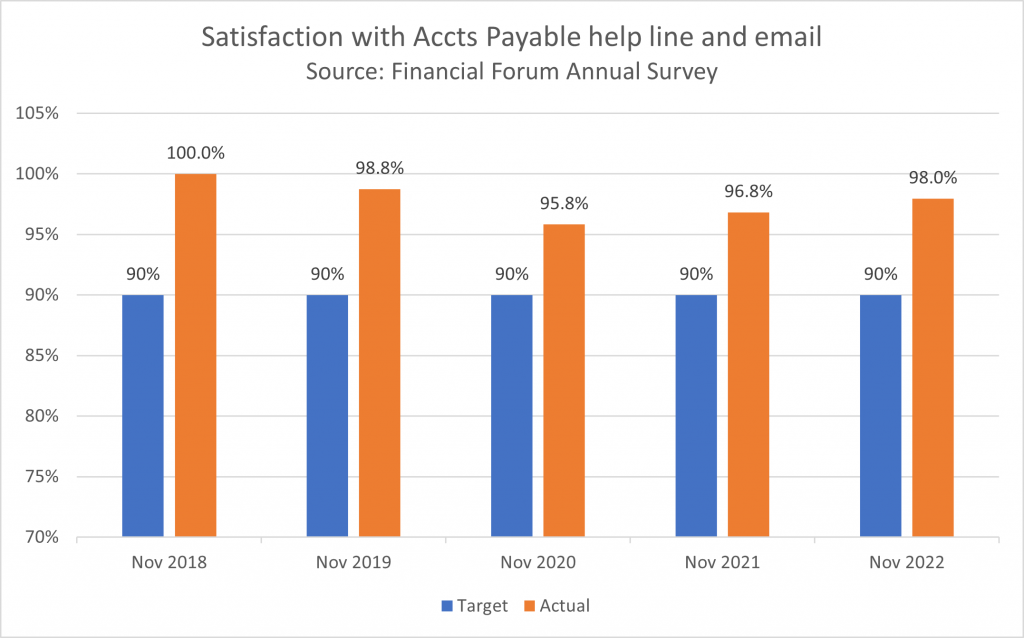

| Source: Annual Financial Forum Survey |

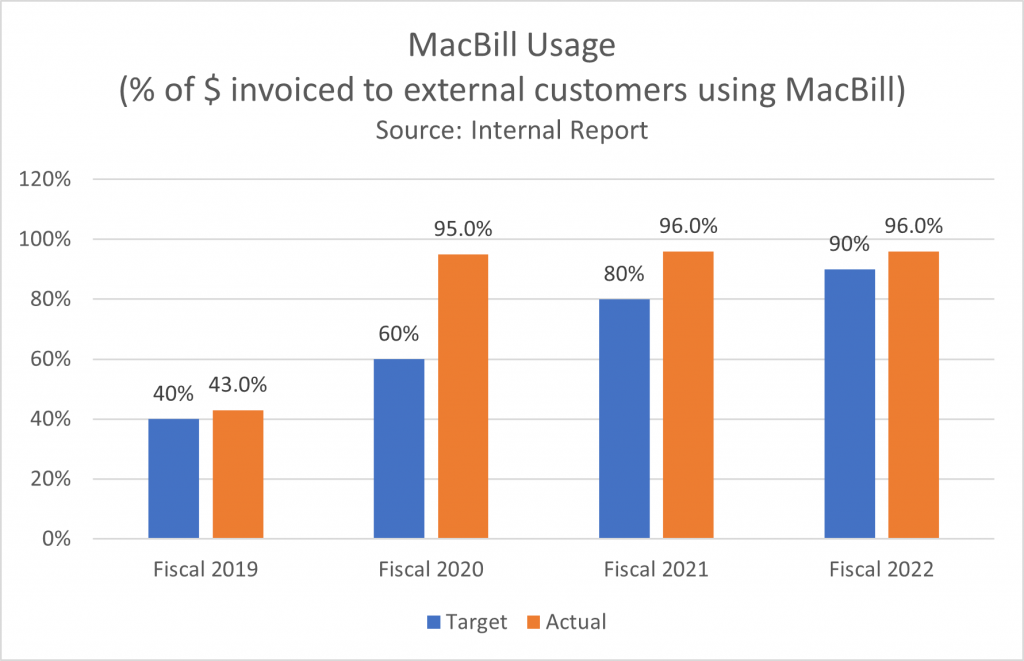

Accounts Receivable

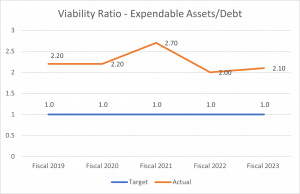

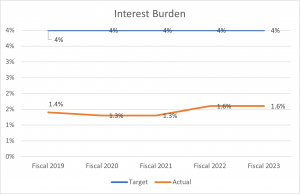

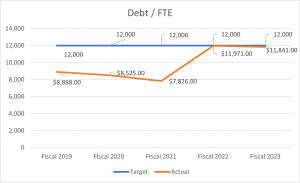

Debt Policy

Investments

| Strategic Indicator | Target 30-Jun-23 |

Actual 30-Jun-23 |

| Investment Pool 4-year Annualized Return better than policy benchmark | 5.3% | 6.6% |

| Source: Third Party, Quarterly Reports of Investment Pool Committee Owner: Treasury |

| Strategic Indicator | Target 30-Jun-23 |

Actual 30-Jun-23 |

| Salaried Pension Plans 4-year Annualized Return better than policy benchmark | 5.0% | 4.8% |

| Source: Third Party, Quarterly Reports of Pension Trust Committee Owner: Treasury |