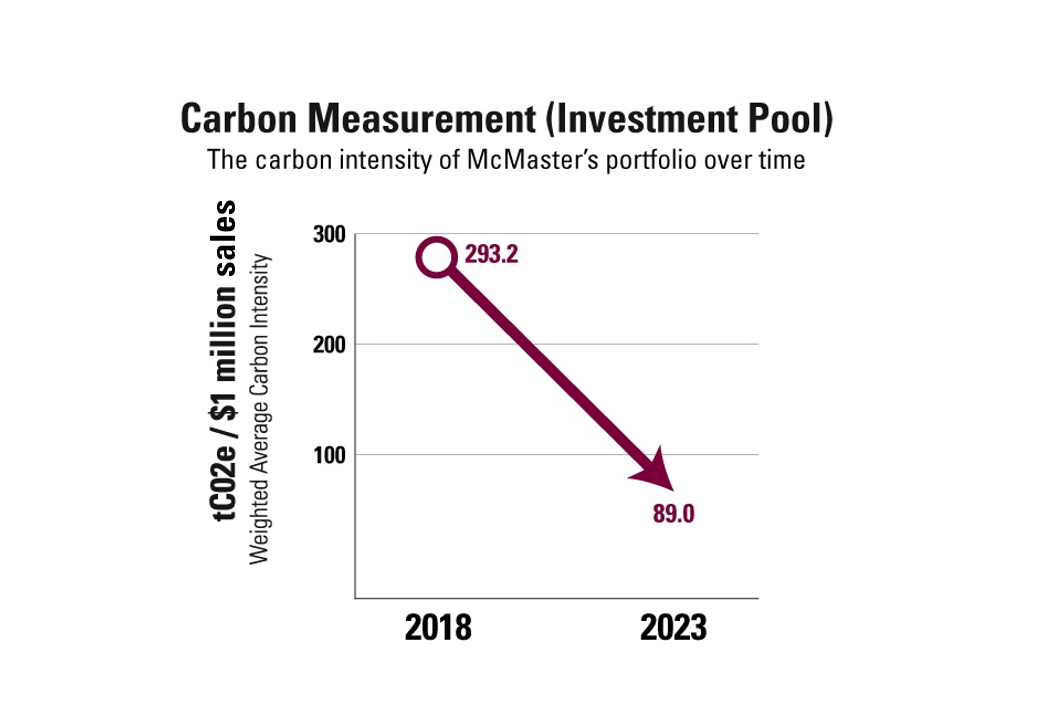

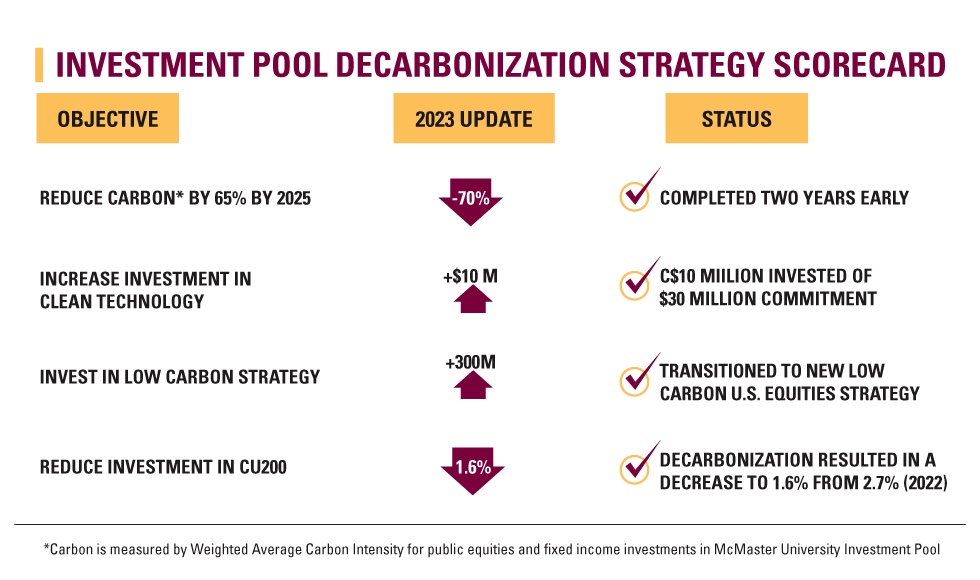

In 2022/23, McMaster attained a significant milestone by achieving its 2025 goal of reducing the Investment Pool’s weighted average carbon intensity (WACI) by more than 65% two years earlier than originally targeted. Approved by the University’s Board of Governors, this achievement was driven by revisions to the University’s investment strategies, including transitioning the US Equities portfolio to a low-carbon investment strategy.

McMaster’s strategy is comprised of two main components:

- Decarbonizing the Investment Pool to achieve climate targets

- New investments to support and enable the global transition to clean energy.

Investing in this strategy has reduced our carbon exposure while managing return and risk. McMaster also took action to re-balance manager allocations and investment products which, coupled with other market factors, further supported reducing the overall carbon exposures.

Investments

Keeping to earlier commitments, McMaster achieved another significant milestone: the University has now invested $10 million in the Brookfield Global Transition Fund, an institutional fund that only invests in infrastructure projects that support the global transition to clean energy. This investment in the Brookfield Global Transition Fund will grow to McMaster’s total commitment of approximately $30 million1 as investments are acquired by the fund.

During the reporting period, McMaster’s exposure to the CU200 declined by 25% to represent 1.6% of the Investment Pool’s investments.

1In 2022 the Board approved a commitment of US$24 million to the Brookfield Global Transition Fund.

Investment Pool – Equity and Fixed income Weighted Average Carbon Intensity. The Weighted Average Carbon Intensity (WACI) measures the amount of carbon a company uses to generate a million dollars of sales. It allows comparison of carbon emissions of a portfolio irrespective of size.

FUTURE OUTLOOK

McMaster will continue with its three-pronged approach to reduce investments in carbon-emitting companies:

Continue to Decarbonize

Continue to accelerate divestments in any fossil fuel holding company that fails to address carbon reduction milestones.

Invest Responsibly

McMaster’s investment managers regularly evaluate our investments to ensure McMaster’s investing policy is aligned with our environmental, social and governance(ESG) considerations and international standards, including the United Nations’ Sustainable Development Goals, and the Paris Agreement’s net zero targets.

Keep Companies Accountable

McMaster is part of the University Network for Investor Engagement, an advocacy and engagement group focused on increased company climate commitments. Through this and other groups, McMaster is using its voice to advocate for companies to reduce their carbon footprint.