Year End 2024 - Reporting Deadlines

| Area | Description | Deadline WD = Working Day |

|---|---|---|

| Accounts Payable | PCard reconciliations for charges up to & including March 31, 2024, submitted & approved by ALL approvers (except A/P) to facilitate posting to fiscal 2023/24.. | Mon Apr 15 |

| Procurement | Requisitions for goods and services received in fiscal 2023/24 must be entered & approved. Supplier set ups must be submitted.

Black out period – Supplier set ups, requisition entry, receipts and approvals |

Fri April 19

Tue April 30 (4:30pm) to Mon May 6 (9am) |

| Accounts Receivable | Deadline to post transactions on the students’ accounts from the Financial Aid module. | Fri Apr 26 (noon) |

| Departmental external file load (i.e., Group post). | Tue Apr 30 (noon) | |

| Campus Solutions Module closed for fiscal 2023/24. | Tue Apr 30 (9pm) | |

| Moneris, cash & cheque deposits entered (other than students, dated April 30th or earlier, received by April 30th). | WD3 – Fri May 3 | |

| A/R module close | WD5 – Tue, May 7 (9am) | |

| Accounts Payable (Note – ALL approvers excludes A/P) |

Purchase Orders (PO) invoices related for goods & services received/completed/in transit by April 30th emailed to appoinvo@mcmaster.ca and wmgreen@mcmaster.ca | WD3 – Fri May 3 |

| PCard reconciliations for charges up to & including April 30, 2024, submitted & approved to facilitate posting to fiscal 2023/24. | WD3 – Fri May 3 | |

| Expense reports for travel prior to April 30th submitted & approved by ALL approvers. | WD3 – Fri May 3 | |

| Non-PO voucher submitted and approved by ALL approvers with an accounting date of April 30th or earlier for goods & services received/completed/in transit by April 30th. Deadline for POs in both domestic and/or foreign currencies. | WD3 – Fri May 3 | |

| Journal Entries (Note: must be completed by 6pm) |

Entered (majority should be by WD5 – May 7th to allow time for approvals) | WD8 – Fri May 10 (6pm) WD5 – May 7 (FHS) |

| Journal entry approvals completed | WD9 – Mon May 13 (6pm) WD8 – May 10 (FHS) |

|

| Journal entry re-allocations to Appropriation closing balances. | WD10 – Tue May 14 (6pm) |

Year End 2024 – Additional Communication

Expandable List

Please see additional information below regarding reporting deadlines:

All new disbursements and/or adjustments/cancellations of existing disbursements must be entered by Fri April 26th in the Campus Solutions Financial Aid module as these transactions cannot be completed by journal. This enables posting in the student account in fiscal 2023/24 and ensures trust and endowment statements are accurate.

If a fiscal 2023/24 cheque deposit is received after April 30th, it must be entered as a May deposit and set up as an accounts receivable for 2023/24, unless the receivable has already been setup through MacBill.

Contact your suppliers to ensure invoices are received and entered by the dates noted. To ensure all goods/services are accurately recorded, the supporting documentation (i.e., invoice and purchase order number if applicable), must clearly indicate the date the goods were physically received or the date the services were completed.

Email aphelp@mcmaster.ca the non-PO voucher number along with “Foreign Payment” in the subject line.

All PCard transactions prior to March statements should be reconciled and approved prior to Wed March 15th. March transactions will be uploaded to My Wallet on Thu March 28th, these reconciliations should be reconciled and submitted on or before Mon April 15th. April PCard transactions will be automatically uploaded to My Wallet on Mon April 29th. PCard transactions submitted and approved by ALL approvers (except A/P) on or before Fri May 3rd (WD3), 2024 will be posted to fiscal 2023/24. Remaining outstanding PCard transactions in My Wallet or in workflow (not fully approved) will be accrued by A/P and available by beginning of business day Fri May 10th (WD8) to the default chartfield on file for the PCard holder in fiscal 2024. The accrual will be reversed in May 2024. Transactions/reconciliations included on the accrual still need to be completed by PCard holders or delegates and will be posted in fiscal 2023/24.

All transactions approved by ALL approvers (except A/P) by the deadline of Fri May 3rd (WD3), will be reflected in G/L balances in Mosaic at the latest by Wed May 8th (WD6). Should a manual accrual entry be required for additional transactions it will be posted and available by Fri May 10th (WD8). Journal entries to accrue unpaid expenses should only be considered once the A/P cut-off mechanisms are exhausted. Should an entry be required, ensure supporting documentation is attached to the journal entry and the entry is set up to reverse in May 2024.

The final full pay period in 2023/24 is ending on April 27th, 2024. In past years the split pay process was utilized to ensure completeness of expenses to end of year. Due to timing, a split pay for 2023/24 would delay the year end close and risk timely completion of the audit, as a result a split play process will not be utilized. To ensure the full amount of expense is included in the consolidated 2023/24 financial statements, the remaining days of April will be accrued centrally and will not be included in departmental results. Please see Appendix A for more information.

Deferral of fees billed prior to April 30th through CS (tuition, supplementary fees, etc.) for services to be rendered after April 30th, are done by Financial Affairs. Therefore, if a fee is billed through CS on the student account, do not defer it. These entries will be posted by Tue May 7th (WD5) with the journal line description ‘23/24 CS Fee Deferrals’.

Prior to year end, managers should review PDA/MPDA open items in their departments. Refer to Mosaic for queries and guidance. In the new fiscal year, Budgeting Services will do the entitlement entries for the fiscal year 2024/25.

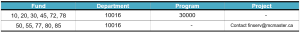

Appropriation balances when fiscal 2023/24 closes are the opening balances for fiscal 2024/25. Should you wish to re-allocate your appropriation balances in Fund 20, 30, 45, 72 or 78 prior to the start of the new fiscal year, a transfer journal entry must be completed before fiscal 2023/24 closes. You may wish to complete this transfer entry on Tue May 14th (WD10) once most year end entries are completed. Account 480099 has been added to separately identify these reallocations and will appear below the total revenues and expenses for Statement of Op’s reports & Hyperion reports. FHS departments should contact FHS Finance by Wed May 10th (WD8) if they wish to transfer appropriations.

BI Statement of Operations Dashboard

The primary reporting tool for your operating statements is the BI Statement of Operations Dashboard. You can access the Dashboard via the Financial Reporting Hub in Mosaic or directly via bi.mcmaster.ca. Please remember to sign in to VPN before trying to access the reports. Additional information about the Dashboard including training documentation and videos can be found here. There are also weekly drop-in support sessions available as follows:

Wednesdays from 2pm to 3pm, options to join:

(1) Teams meeting link

(2) Meeting ID: 296 678 987 404 Password: zKgwTc

Fridays from 11am to 12pm, options to join:

Quick guides for running reports and queries can be found in Mosaic within Support and Documentation. Alternatively, most commonly used reports and queries can be found all in one place within the Financial Reporting Hub tile within the Administrative Home Page.

Mosaic Finance Module Training Hub

A consolidation of all Mosaic Finance module training documentation and self-paced video tutorials can be found in the Finance Training Hub accessible via the Finance Training tile within the Administrative Home page in Mosaic.

There are also weekly drop-in support sessions available as follows:

MacBill: Tuesdays from 10am to 11am, options to join:

(1) Teams meeting link

(2) Meeting ID: 248 289 341 992 Password: sWRUEF

MacBuy: Tuesdays from 2pm to 3pm, options to join:

(1) Teams meeting link

(2) Meeting ID: 253 607 400 367 Password: 6FiZNQ

GL and Journal Entry: Thursdays from 9:30am to 10:30am, options to join:

(1) Teams meeting link

(2) Meeting ID: 221 890 341 542 Password: 5MXyzR

Actual updated results will be available daily in Hyperion for funds 20, 30 and 45 beginning Mon April 8th. Hyperion will be refreshed by approximately 9 am each day once the upload is completed.

Since 2021, the final pay period of the fiscal year has fallen on April 30 or the following weekend, so that all working days were included in the final payroll entry posted in May. In 2024, the final full pay period ends on April 27. Since most employees will work on April 29 and 30 of the next pay period, these additional two days will need to be recorded in 2024 business.

Prior to 2021, the final payroll entry was split between the old and new fiscal years. The entry was posted early in May allowing time for departments to see their final balances and make adjustments. If the final payroll entry were to be split in 2024, it would not be posted until May 16, past the cut-off for journal entries. Extending the journal entry cut-off would delay the year-end close and risk timely completion of the audit.

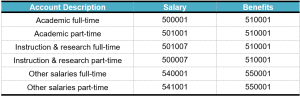

To ensure that the full amount of expense is included in the consolidated 2024 financial statements and maintain the year-end schedule, the extra days will be estimated based on 20% of the April 27 pay period and accrued centrally. The extra days will not be included in departmental results and there is no requirement to accrue them. This will result in a favourable variance to budget of approximately 0.8% of the annual total salaries and benefits. If managers want to accrue an estimate in their departments, a reversing journal entry may be done crediting the central accrual in the appropriate fund using the chartfields below. To simplify the entry, a limited number of account codes will be used for the central accrual.

As we move forward, there are three main goals:

- Timely year-end close

- Accuracy of consolidated statements

- Accurate departmental results

Given the timing of year-end pay periods, it is most appropriate to use this process through 2028 as one additional day is added to the accrual each year. Beginning in 2029, the timing of the year-end pay period may better align to the split pay process. This will be assessed as we approach that fiscal year.

Year End 2024 – Contact List

| Description | Contact |

|---|---|

| Procurement – Purchase requisitions | Tracie Felton – feltont@mcmaster.ca |

| Accounts Receivable and Other Deposits | Dianna Creamer – creamerd@mcmaster.ca |

| Moneris Deposits | Brandon Le – lel20@mcmaster.ca |

| Accounts Payable & PCard | Sharon Patry – patrys@mcmaster.ca |

| Purchase Order payments | Wendy Green – wmgreen@mcmaster.ca |

| General ledger, journal entries, chartfields, queries, reports | finserv@mcmaster.ca |

| Prepaid expenses & accruals, capital account thresholds | Saad Khan – khans108@mcmaster.ca |

| Deferral of campus solution transactions | Helen Chen – chenh17@mcmaster.ca |

| Workflow updates and issues | finworkflow@mcmaster.ca |

| Trust and Endowments | Cindy Liu – liucj2@mcmaster.ca |

| PDA/MPDA, Salary and Benefit Account Codes | Chris Sylvester – sylvest@mcmaster.ca |

| Appropriation transfer entries | Budgeting – bsinfo@mcmaster.ca |

| Hyperion | Alfredo Sordo – sordoa@mcmaster.ca |

| FHS | Kathy Pfeiffer – pfeiffe@mcmaster.ca |

| FHS Research | Ruby Nguyen – nguyenrp@mcmaster.ca or Sonya Caissie – caissie@mcmaster.ca |

| Research | Sheila Williams willis79@mcmaster.ca or Dave Reinhart – reinhard@mcmaster.ca |

| Payroll – one time payments | Your Departmental HR Advisor |